The Sun and The Earth

Disclaimer: I’m late by one-week and some change. If you expected a weekly update, here’s what happened. I had the gall to get married last week. It was awesome but overloaded our minds with wedding planning details that consumed our spare time.

I’m back on my commitment to keep the blog juices flowing. So without further ado…

In our previous episode, much of civilization thrived in a world of hard money: gold. But it wouldn’t last. Today, we explore what happened. I play loose with historical facts, but the gist is earnest.

To learn the granular, I recommend The Bitcoin Standard by Saifedean Ammous or The Dollar Crisis: Causes, Consequences, Cures by Richard Duncan.

Once printable, the temptation to print more money is too great. This temptation led to the bloodiest wars in history.

Conversely, when we bought war with gold, the reigning sovereigns taxed their citizens to pay their soldiers. This forced redistribution of real wealth was the primary way to sustain war.

But how many times can one heartlessly raise taxes to fight their twice-removed cousin who deemed their spring frock unworthy of the Midsummer ball? Either the people reject the taxes, or the well runs dry. In both cases, the war comes to a halt thanks to dear old bankruptcy.

However, by switching to gold-backed paper money, those in power could print more paper in lieu of raising funds the traditional way. But what happens when you start buying soldiers, guns, ammunition, food, horses, and clothes with cheap money?

The money supply inflates and the people take notice. The wisest citizens exchange their few papers for gold at the original rate. Soon, the gold supply shrinks and the powers at-be reduce the rate of exchange to stem the bleeding. Too late.

Reducing the rate causes a panic, and a panic leads to a run on the gold supply. This makes matters worse for the ruler and the currency they manipulated. Ultimately, the sovereign runs out of gold (that’s a laugh) or refuses to surrender a single nugget (the likely scenario). And that exact situation played out in 1971.

During the first World War, warring nations abandoned the gold standard shortly after issuing paper money. Collectively, these actions brought an end to the gilded age. Easy money fueled the greatest war the world ever witnessed.

The first World War claimed more lives per year than all wars preceding it: 10-million per year. For comparison, the Mexican Revolution began in 1910 and ended a decade later claimed approximately 2-million lives. The great war stole lives 50x faster than the revolution.

The sequel saw an inflated budget and consequences far more disastrous, as sequels are want to do. The pattern repeated itself. Easy money fueled Hitler’s 3rd Reich into a national war machine. No surprise there; Ammous notes every tyrant in history depended on easy money. However briefly, loose cash funded the greatest production of war materiel on record.

During World War 2, another 70-million lives were lost to the tyrannical ideas propped up by worthless money. Even if the Nazis had won every battle, their war was lost — their monetary policies would crumble the world’s economies, including their own.

But that’s not how things went down. And after the war, the world came up with an answer to the fast-cash war-machine problem. And like applying a band-aid on the victim of a train wreck, it totally worked.

To prevent countries from manipulating their currencies to fund catastrophic wars, participating economies entered the Bretton-Woods Agreement.

This globe-spanning arrangement crowned the United States as the world’s gold reserve. And the dollar became the base currency by which all participant currencies would compare themselves.

The World Bank and the International Monetary Fund (IMF) would oversee the conversion between currencies by setting exchange rates and regulating participants. Meanwhile, every $35 dollars was pegged to a fixed weight of gold held by the United States Federal Reserve.

Governments, not individuals, could trade their currencies into dollars, and their dollars into gold. But few countries did; they preferred to live in the illusion of sound money.

This agreement aimed to level the playing-field. However, nations remained responsible for printing and distributing their native paper money… can you see where this is going? The temptation to gain temporary boosts in purchasing power via currency manipulation, again, proved too great.

I believe the FIAT money system would fail if any large economy chose to drop it. For one, the FIAT currencies cannot participate economically with countries operating on gold. The “price” of gold, if it can have such a thing, proves too volatile to FIAT money-holders. They cannot agree on the value of a transaction.

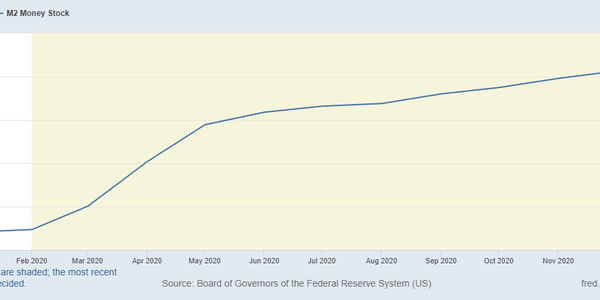

As FIAT money users, we see gold as an unstable commodity. However, gold rarely increases its supply by more than 2% annually, and that’s held true since the beginning of gold. By contrast, the M2 dollar supply increased by 26% during a single year: last year. We went from having $15.4 trillion in circulation to $19.4 trillion in 12-months.

Prior to 1543, the sun couldn’t be trusted. It showed up, it left, it went high in the sky, then dropped back down. And it changed trajectory throughout the year. It was a flaming hot ball of mess.

Then Nicolaus Copernicus posited an idea, and I’m quoting verbatim here. “Perhaps the Sun sits still, and it is the Earth which toddles around it like a drunken co-ed on spring break.” Today, we all remember Nicolaus’ original thoughts, because they were correct.

And if you’ve ever looked at the Sun, it happens to shimmer golden rays.

Back to the story. Even with Bretton-Woods firmly in place, countries printed excess cash, easy cash. I presume some were caught, some reprimanded by the World Bank, and some destroyed their economies.

And in the late 60s, nations saw the writing on the wall. France was the first country to get its gold back. Unfortunately, the U.S. over-printed the dollar, and wasn’t ready to satisfy additional requests.

The truth was out there: more dollars were in circulation than could be redeemed for gold. England was the second country to stick up its finger and shout, “check, please!” They would not see their gold again.

In 1971, president Nixon dismantled the Bretton-Woods agreement and took the U.S. off the gold standard. Overnight, a dollar became a dollar, a FIAT money; it no longer represented the greatest money ever discovered, nor the greatest money ever invented.

To learn why cryptocurrencies are our chance to save us from baseless money and the precarious economic conditions under which we live, you’ll have to read part three.